Hello Antagonist members,

Welcome to the monthly issue of our Blend Portfolio.

Here’s what’s on tap:

Cheap, hated, and in an uptrend

Stocks that will benefit from rising food prices

The two stocks to buy now

Review of other Blend Portfolio positions

New dashboard location

Cheap, hated, and in an uptrend

Renowned investor Steve Sjuggerud follows a simple—and very profitable—investing mantra: buy stocks that are cheap, hated, and in an uptrend.

When a stock fits these 3 criteria, substantial gains often follow.

Why?

The first two criteria go hand-in-hand. When investors hate a stock, they sell it or at least avoid buying it. That causes the price to fall (i.e. it becomes cheap).

But just because a stock is hated and cheap doesn’t mean you should buy it.

There are countless reasons why a stock may fall out of favor with investors. The company might be poorly managed. It could be losing to a competitor. It might be in trouble with regulators. Or, it just might be a bad business that has failed to adapt to changing markets.

My point is that “cheap and hated” isn’t an automatic buy signal. The key is finding a business that investors are unfairly punishing.

Even the best companies have a bad quarter or even a bad year. Sometimes their struggles aren’t even related to the business itself. If an overall industry faces headwinds, the companies within that industry will often suffer.

Your task is to uncover solid businesses that represent excellent long-term investment opportunities but are facing a temporary setback.

Take Amazon (AMZN) for example. When the tech bubble burst in 2000/2001, internet companies got crushed, and Amazon crashed 94%!

Was it really that bad of a business? Of course not. It just got caught up in the storm as investors dumped internet companies.

AMZN isn’t actually the best use-case for us though since it took the stock years to rebound. The Blend Portfolio is for long-term holdings, but we don’t want to wait that long to realize our profits.

That’s why we’re not going to buy stocks that are either still falling or just camped out on the bottom. We want to find companies that have already bounced off their lows.

That’s what the “uptrend” criteria helps you do.

Perhaps you’ve heard the investment saying, “Don’t try to catch a falling knife.”

That’s when you attempt to predict when a stock will bottom, which is impossible to do consistently. More often than not, the stock will continue to drop after you buy it.

That’s where the falling knife analogy comes from. Unless you time it perfectly, you’re gonna get hurt.

Rather than trying to time a stock’s bottom, it’s best to wait until it’s in an uptrend. Sure, you’ll miss out some of the gains. But that’s far better than watching your investment plummet.

Plus, if you buy a solid business that’s rebounding from a temporary setback, you’ll still have plenty of upside in front of you, even if you missed the initial gains.

In other words, avoid market timing. Instead, let a stock’s momentum be your signal. When your cheap and hated company is in a solid uptrend, that’s your moment to buy.

Less risk

Another advantage of cheap and hated stocks is that they are less risky. Unlike overhyped stocks that are selling at ridiculously high valuations, cheap, hated, in-an-uptrend companies have already bounced off their lows. Even if they pull back, the drop isn’t as steep as when overbought stocks crash.

Stocks that will benefit from rising food prices

The two stocks that I’m recommending are “cheap and hated” due to industry-wide challenges. Some of the key inputs the companies use to produce their products have also become more expensive, which has hurt their margins. Both of these factors have scared investors away.

Recently, however, demand for these businesses’ products has picked up significantly. Their stock performances also reflect this shift as they’ve been in a solid uptrend for the last month.

Before I get into the specific companies, however, let’s look at a global trend that’s providing significant tailwinds.

Rising food prices and a global agricultural crisis

Food is getting more expensive, and that trend is likely just beginning.

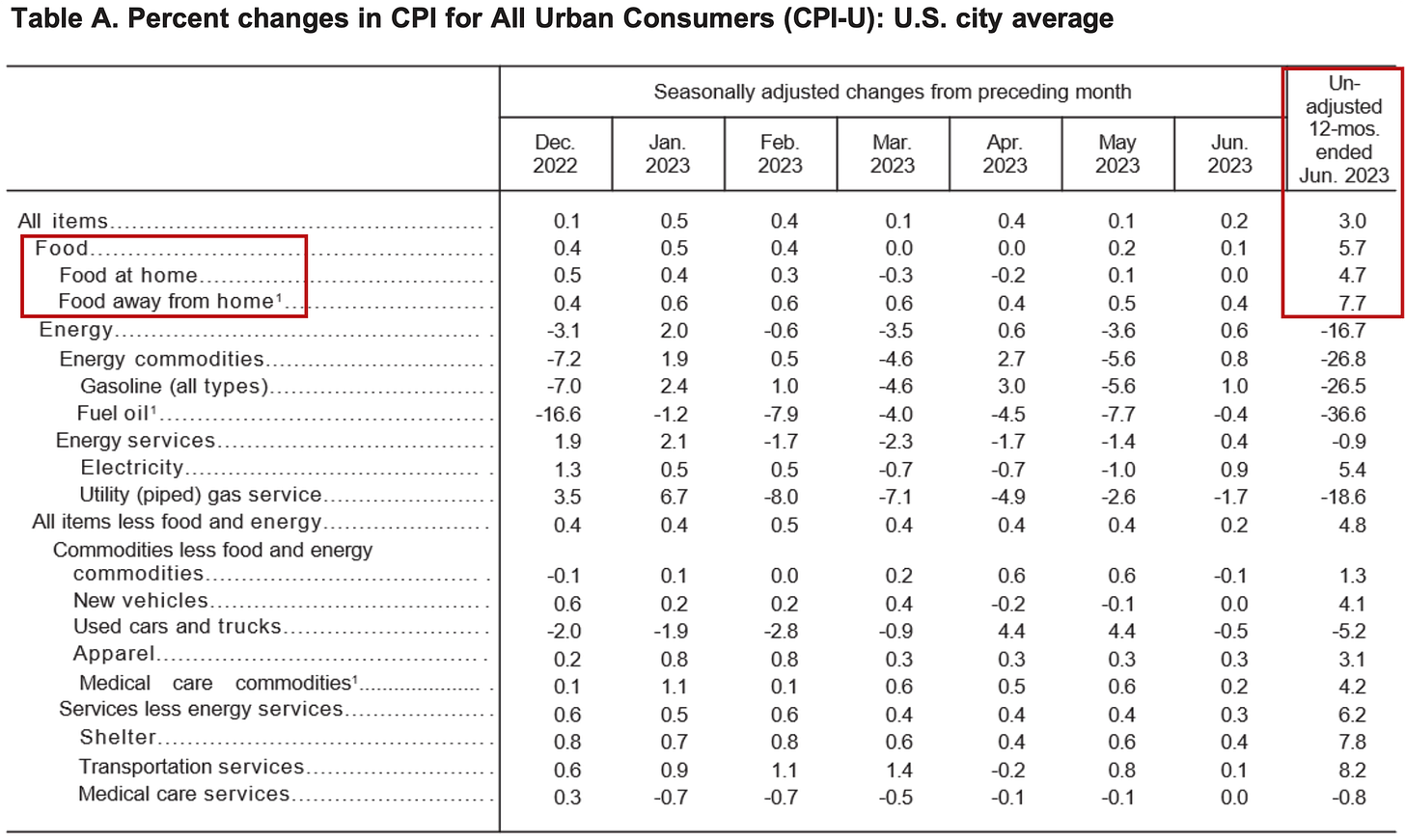

In the U.S., food prices are 5.7% higher now than they were last year, according to the latest consumer price index (CPI) report.

Globally, it’s even more concerning. It’s not an exaggeration to say that the world is on the brink of an agricultural crisis, driven by a substantial increase in the demand for grain over the last 20 years.1

This surge is primarily due to the rise in disposable income and a shift in dietary preferences among emerging economies. As these economies grow, more people are transitioning from a starch-based diet to a protein-rich one, which in turn increases the demand for grain (animals gotta eat too!).

This trend is expected to persist throughout this decade, putting further pressure on the global food supply.

The impact of geopolitics

Russia’s invasion of Ukraine exposed just how fragile the global food trade is. Those two countries account for 30% of the world’s wheat exports and 20% of corn exports. After the invasion, food security for millions of people eroded overnight.

Prices skyrocketed as well. Global wheat prices increased over 60% from February 24 to June 1, 2022 compared to the average in January 2022.

Weather is a problem too

To state the obvious, weather plays a big role in agricultural production.

Large parts of North America, Europe, and Asia are currently in the midst of crippling heat waves. Before I go any further, please note that The Antagonist is not a political publication. I am not pushing either side of the climate change debate.

My point is simply that right now, it’s really hot outside. And extreme heat threatens food production, which is directly related to our new stock positions.

Additionally, weather phenomena such as El Niño and La Niña, the Gleissberg cycle, and the Pacific Decadal Oscillation could potentially cause severe drought conditions in North America. That’s according to Leigh Goehring, co-founder of Goehring & Rozencwajg (G&R), a natural resource investing firm.

In the interest of time, I won’t go into all the details of these phenomena. If you’d like to learn more, check out Goehring’s interview on this MacroVoices podcast.

For now, it’s sufficient to say that if Goehring’s research and drought forecasts are correct, we’re likely see a decrease in grain supply and a subsequent increase in grain prices.

The best industry to own

In the face of these agricultural challenges, it’s tempting to invest in commodities like wheat, grain, or cattle. And that can certainly be a winning strategy. In fact, we already hold several commodities in our Blend Portfolio.

There’s a more effective way to play this, however. We’ll instead invest in businesses that will not only benefit from rising prices, but can also help people during a crop shortage.

I’m talking about fertilizer companies.

While these businesses are still connected to wheat, grain, and cattle, they also offer several advantages over investing in the commodities themselves:

Leverage to price changes: Fertilizer companies can often provide more leverage to price changes in agricultural commodities. When the price of crops increases, the demand for fertilizers also rises as farmers try to maximize their yields. This increased demand can lead to higher fertilizer prices, which can significantly boost the profits of fertilizer companies. In contrast, investing directly in commodities exposes investors to price volatility without the potential for increased profit margins that fertilizer companies can offer.

Diversification: Investing in fertilizer companies allows for diversification. These companies often produce a range of different fertilizers and other agricultural products, which can help spread out risk. In contrast, investing in a single commodity can expose investors to more risk if the price of that commodity falls.

Dividends and corporate actions: Fertilizer companies often pay dividends to their shareholders. This can provide a steady income stream in addition to any capital gains from the increase in the company’s share price. Commodities, on the other hand, do not pay dividends. Additionally, companies can undertake actions such as share buybacks, mergers, and acquisitions, which can create additional value for shareholders.

Ability to innovate and adapt: Companies have the ability to innovate, improve efficiency, and adapt to changing market conditions. They can invest in new technologies, enter new markets, and make strategic decisions that can increase their profitability. Commodities, however, are subject to market forces and environmental factors that are often beyond the control of investors.

Less direct exposure to environmental factors: Commodities like wheat, grain, and cattle are directly exposed to environmental factors such as weather conditions and diseases. Unfavorable weather or a disease outbreak can significantly impact the supply of these commodities, leading to price volatility. Fertilizer companies, while also affected by these factors, are more insulated since they are one step removed in the supply chain.

What if our food/agricultural thesis is wrong?

What happens if all the research and forecasts are wrong? What if food prices come down, there is no drought, and/or global demand swoons?

All of those scenarios are certainly possible. But that’s where our cheap, hated, in-an-uptrend criteria in addition to our Blend Portfolio’s growth-at-a-reasonable price (GARP) investing strategy comes in.

For the Blend Portfolio, I only select companies that have solid fundamentals, are undervalued, and have plenty of growth potential. Every stock I add must also pass the scoring system and stringent criteria that I discussed here.

The two stocks that I’m adding today are no exception. This means that even if the macro factors that I’ve discussed don’t play out, we’ll still own solid companies with excellent growth potential.

Additionally, like most fertilizer companies, our two new holdings experienced a significant pullback over the last year. They were down nearly 50% from their highs!

Since bottoming out, however, both our stocks have staged a strong rally (hence, our “in an uptrend” criteria). In fact, even now they’re trading higher than they were in 2021.

Why does this matter?

Because our two new stocks are grossly undervalued by the market. Simply put, they have far more upside than downside. Granted, if agricultural prices and demand fall, we likely won’t reach the gains I’m expecting. But that doesn’t we mean we won’t profit at all.

The companies I’ve selected are fundamentally sound, and they don’t need a global agricultural shortage to succeed. Investors have overreacted and oversold these businesses. When the market realizes this, they’ll buy back in, and the stocks will rise to their fair-market value. That will result in excellent gains.

But if the agricultural supply/demand forecasts are correct, we will likely see far greater profits.

Remember, the Blend Portfolio is for long-term investments. Since we buy stocks that nearly everyone hates, it can take a while for our positions to climb. When they do, however, their market-beating gains make them well worth the wait.

The two stocks to buy now

Enough with the macro! Let’s talk about the two companies I’m adding to our portfolio.

As a reminder, both stocks meet my scoring and evaluation criteria. Rather than rehash that here, I’ll focus on the other reasons why they represent excellent buying opportunities right now.

Here’s a breakdown of each:

Keep reading with a 7-day free trial

Subscribe to Antagonist Stocks and Options Research to keep reading this post and get 7 days of free access to the full post archives.