Hello Antagonist members,

I’m changing things up a bit. Up until now, I’ve published a separate deep dive and Blend Portfolio update each month. Starting today, I’m going to combine the two.

I made this decision because the topics of the articles tend to overlap. By combining the two issues, I can reduce the number of emails you receive from me without sacrificing content.

Of course, the biggest difference between the deep dives and the Blend Portfolio updates is the latter includes new position recommendations. That won’t change.

Free subscribers will be able to read my macro, sector, and/or industry commentary, but Blend Portfolio updates will be behind a paywall that’s reserved for premium members.

If you’re not yet a premium member, you can get sign up for a free, 7-day trial here.

If you have any questions about these changes, please feel free to contact me by replying to this email.

Otherwise, let’s dive in!

Contents:

Big gains outside of stocks.

Doubling down on a winner.

Buy the beta.

Our new position.

Big gains outside of stocks.

Despite the gains we saw at the beginning of the year, I remained skeptical of the stock market’s performance. Most of my concerns stemmed from the fact that only a handful of stocks were holding up the entire market.

I admit that I was a bit early in my assessment as stocks continued to rally even after I raised warning flags. The last 3 months, however, have been brutal for equities. As of this writing, all 3 major stock indexes are down considerably since July 31:

S&P 500 (SPY): down 7.3%

Nasdaq (QQQ): down 6.8%

Russell 2000 (IWM): down 16.4%

Economic data has also been troubling with the number of corporate bankruptcies increasing, loan defaults rising, and credit spreads widening.

Add all of this to persistently high inflation, rising oil prices, and geopolitical conflicts like Ukraine/Russia and Israel/Hamas raging with no end in sight, and I just don’t see a reason to overweight equities right now.

That’s not to say that you shouldn’t own any stocks, however. I personally own several, and we hold many stock positions in our Blend portfolio as well.

But I’ve shied away from adding new money to equities, or at least to stocks that are highly correlated to the overall market.

In our long-term Blend Portfolio, I’ve rotated to commodities and precious metals. With our short-term Challenge strategy, I’ve been buying bear put spread options, which let us make money when stocks fall. The results have been excellent so far:

Highlights from our recent options trades:

54% gain in 13 days with a SPDR S&P 500 ETF (SPY) bear put spread.

47% gain in 20 days with an iShares Russell 2000 ETF (IWM) bear put spread.

29% gain in 2 days with an Airbnb, Inc (ABNB) bear put spread.

13% gain in 25 days with a NASDAQ-100 ETF (QQQ) bear put spread.

Our long-term portfolio is crushing the market average by 4x.

Commodities have driven our Blend Portfolio to an average return that’s nearly 4x better than the S&P 500 over the same time period.

Our top performer is a commodity that’s up over 43% since we added it at the end of June (more on this one below). Meanwhile, the S&P 500 has lost over 4% since then.

Our second and third best-performing holdings are energy companies that are up 37% and 30%, respectively, since adding them on April 17th. The S&P 500 has gained just 3% since then.

Two of our other commodity-based positions are up nearly 13% and 7%, respectively, since May 24th. Meanwhile, the S&P 500 rose only 3.4% over the same time period.

(To see all of our Blend Portfolio positions and read why I selected them, click here to upgrade to a premium membership.)

Doubling down on a winner.

The top-performing commodity that I mentioned above is uranium. Our position has gained over 43% since we added it on June 30. (You can read about our specific holding in this article.)

Even after this stellar run, I’m still extremely bullish on uranium and believe that it has plenty more growth ahead of it. Granted, we’ll probably see some pull backs in the near future, but I see those as opportunities to add to our position.

That’s not what I’m doing this month, however. Instead, I’m recommending a company that has the potential for triple-digit returns as the price of uranium continues to climb.

Before I reveal which stock this is, however, let’s review why I’m so bullish on uranium long term:

Reason #1: Increasing demand

The World Nuclear Association expects the number of nuclear reactors to climb by 28% by 2030 and nearly double by 2040 as nations try to meet zero-carbon targets.

Reason #2: Uncertain supply outlook

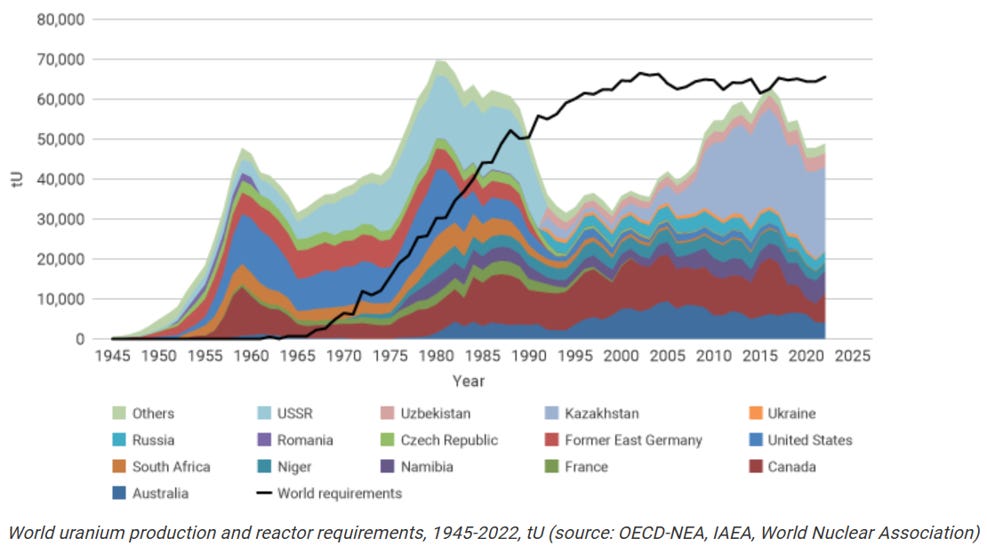

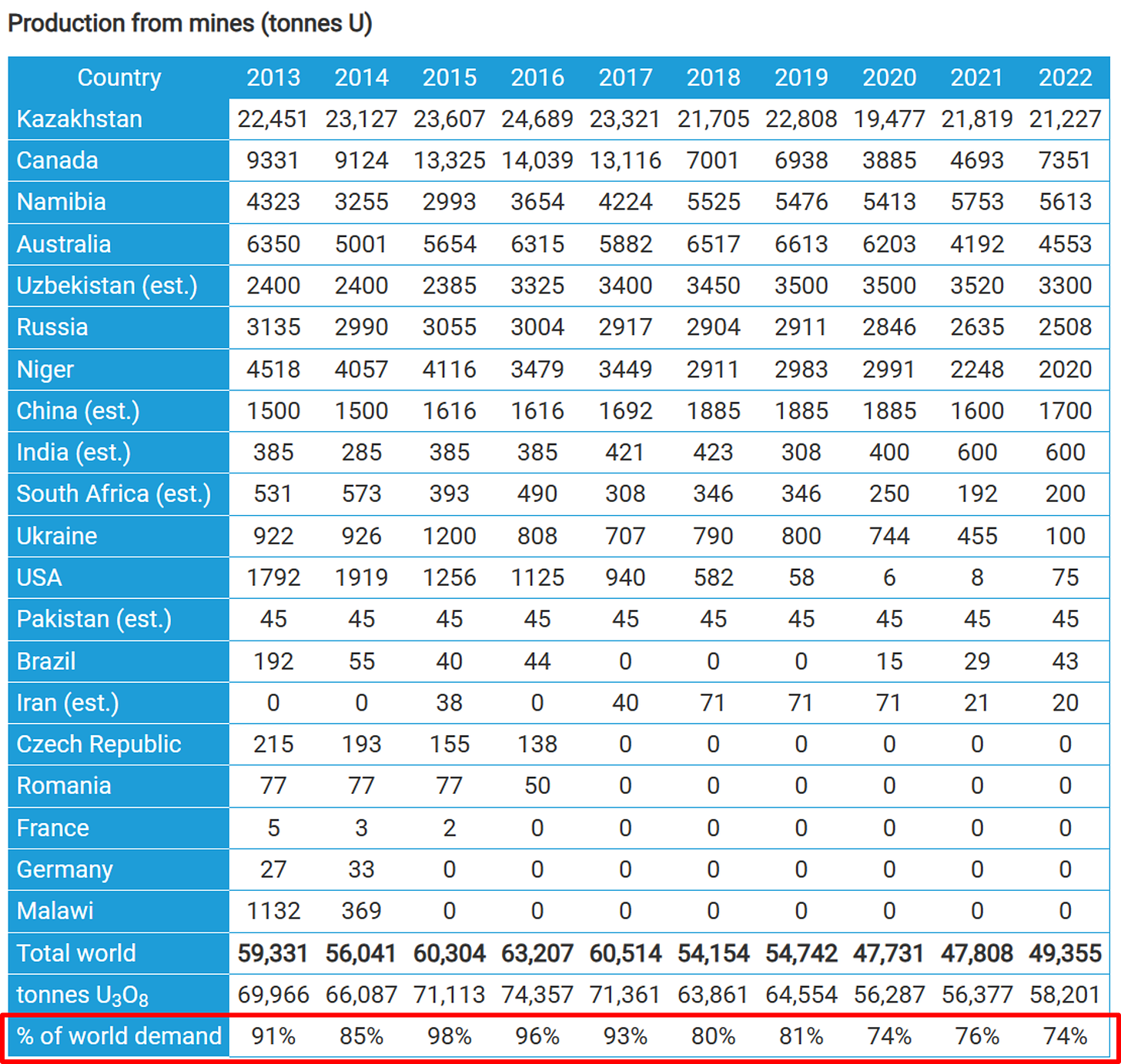

Production from world uranium mines doesn’t meet the requirements of power utilities. The shortfall has been supplemented by secondary supplies like recycled products and stockpiles.

According to the World Nuclear Association, our known uranium resources are adequate to meet reactor requirements up to at least 2040. The problem, however, is that oversupply and associated low uranium prices have prevented the investment needed to convert these resources into production. This situation has resulted in decreased uranium exploration and reduced production at existing mines.

To address the emerging supply/demand gap, uranium prices will have to rise. That’s bullish for uranium itself and for uranium companies like the one I’m recommending this month.

Reason #3: Portfolio diversification

Uranium is largely uncorrelated with other commodities and financial assets. The drivers of uranium prices—nuclear power demand, long-term contracts, and supply constraints—are much different from those affecting oil and gas markets.

Buy the beta.

Dan Ferris, a highly respected financial researcher, recently talked about how investors could achieve solid gains if they simply “buy the beta.”

Most of the time, investors are trying to generate positive “alpha.” Alpha refers to the excess return of an investment relative to a benchmark index or other standard. In simpler terms, it’s when an investment performs better than would be expected given its risk (as measured by beta).

For example, if a stock portfolio outperforms the S&P 500 index, which is often used as a benchmark for U.S. stocks, it’s said to have generated positive alpha.

Positive alpha is obviously a good thing. We’d all love to achieve above-average returns.

Why, then, would you want to “buy the beta”?

Ferris was referring to when you believe that an entire industry will perform extremely well for years. Rather than trying to beat the returns of that industry, just buy its blue chips.

For instance, if you think technology stocks will soar, you could simply buy Google, Meta, Apple, etc. While smaller, lesser-known companies could perform better than those behemoths, they also carry more risk.

During the technology bull run, if you only owned the mega-caps, you still would have done quite well. And, you would’ve taken on less risk than investing in smaller companies.

That’s what we’re going to do with uranium. There are several “junior miners” we could invest in. That term refers to small or mid-size exploration companies that are in the process of searching for new mining deposits.

Junior miners offer the potential for enormous gains, but they also carry much higher risk.

If my uranium hypothesis is correct, there’s no need to take on that risk. If we simply buy the beta (i.e., an industry leader), we’ll still enjoy substantial returns that beat the S&P 500.

And that brings us to this month’s recommendation: