Discover more from Antagonist Stocks and Options Research

A Simple, Low-Risk Investing Strategy to Beat the Market

Even my children learned how to use it

While I’m mainly focused on helping people generate short-term profits, I recognize that long-term investing is critical to achieving financial goals. Therefore, I’d like to introduce you to a free and simple strategy to deploy in your retirement account or with money you have set aside for the long term.

It’s called the Papa Bear by Muscular Portfolios. (Note: I am not affiliated with this organization in any way. I’m recommending the Papa Bear based on its supporting research and my personal experience with it.)

Analyses have shown that over a full market cycle, the Papa Bear portfolio beats the returns of the S&P 500 with far less volatility and risk (see here, here, here, and here). This strategy only takes 10 minutes per month to implement, and it’s so simple that a child can do it. And I mean that literally. My four children (ages 8–14) use the Papa Bear in their own accounts.

A “full market cycle” includes both bull and bear markets. Anyone can make money during a bull market. The real test of skill comes when the market turns against you.

If you want to win, don’t lose

Minimizing losses is crucial to investing success. Everyone, including professionals, will lose money on some of their trades. The key is to manage those losses so that you don’t sink your entire portfolio or put yourself in such a big hole that it takes months or even years to climb out of it.

Let’s use some basic math to illustrate the importance of managing your losses. Imagine that you buy XYZ stock for $100. In the next few months, shares plummet 50% and are now selling for $50. Many people mistakenly think, “I’m down 50%. I need to gain 50% to get back to even.”

Wrong!

In this scenario, XYZ shares are selling for $50. If they gained 50%, the price would only rise to $75.

$50 x 50% = $25

$50 + $25 = $75

If you experience a 50% loss, you need to gain 100% just to get back to your starting point!

$50 x 100% = $50

$50 + $50 = $100

Granted, this is an extreme example. The point is that it’s much easier to fall into a hole than it is to climb out of it.

That’s why the Papa Bear is so effective. It keeps losses small during market downturns. This allows you to quickly return to positive territory when the market turns bullish again.

The Papa Bear strategy has two main components:

Underperform the S&P 500 with less volatility during bull markets.

Keep losses small during bear markets.

The result is a superior performance vs. the S&P 500 over each complete market cycle.

The most challenging part of this strategy is component #1: underperform the S&P. Investing is as much about controlling your emotions as it is about research and math. When you see your portfolio trailing the benchmark, it’s easy to get frustrated and want to change things up.

Remember, however, that this strategy is designed for the long-term. Any gains you miss out on during a bull market will be more than compensated during a bear market. For example, when the market crashed in the Spring of 2020, the S&P nosedived more than 33%. The Papa Bear portfolio, meanwhile, only lost 8%.

That’s a massive difference not only in profit/losses, but also from an emotional perspective. Many people claim that they can handle investing risks. But you don’t really know your risk tolerance until you’re down a bunch of money.

Imagine losing one-third of your retirement savings in a matter of weeks. That’s gut-wrenching for most people. This leads to emotion-driven decisions that make matters even worse.

As their portfolios continue to shrink, people panic-sell their stocks, which locks in losses. Selling isn’t necessarily a bad strategy. In fact, it may be the right move to protect your portfolio during a downturn.

But you should decide on your sell points (called a trailing stop or hard stop) before the market crashes. You should know your sell triggers at the time you buy a stock, not as part of an emotional reaction to a market crash.

Panic selling is often followed by hesitation. Even when the market rebounds, you may be too nervous to jump back in. This will cause you to miss out on recovery profits, which makes it even more difficult to recoup your losses.

This is a huge advantage of the Papa Bear. By keeping your losses small, the strategy protects you from making emotional, panic-driven decisions. It also shifts the math in your favor. When you’re down only 8% vs. 33%, it is far easier for you to not only recover your losses but to also achieve profits.

Therefore, it is vital to keep this bear-market perspective in mind during the good times. While your Papa Bear portfolio is trailing the S&P 500’s gains, remind yourself that you will catch up (and then some!) when the market inevitably turns negative.

How to implement the Papa Bear

I mentioned that the Papa Bear portfolio only takes 10 minutes per month to implement and that it’s so simple, even children can do it. Those are not exaggerated claims.

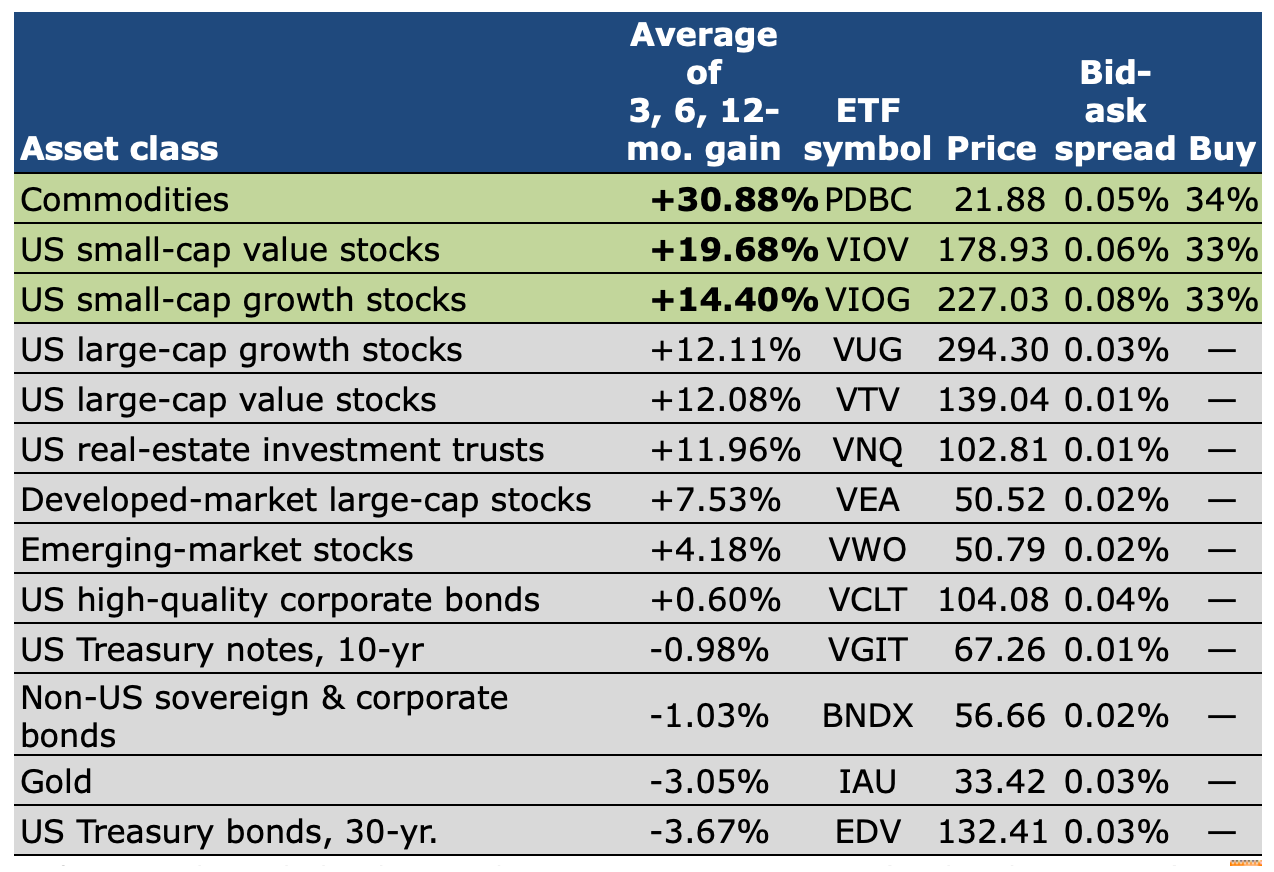

The Papa Bear tracks the performance of 13, low-cost ETFs that you can trade commission free with most online brokers. One day per month, you simply check this site to see which 3 ETFs have achieved the best gains over the average of the last 3, 6, and 12 months. You don’t have to calculate anything. All the work is done for you.

You then buy the top 3 ETFs, splitting your money evenly across them. Sometimes the top 3 change. Sometimes they’re the same. If it’s the latter, do nothing. If the former, adjust your investments accordingly. That’s another reason why this strategy works nicely in retirement accounts. You won’t pay capital gains taxes when you change your investments.

As far as timing goes, you can trade whenever you’d like. An outside analysis, however, revealed that reallocating on the last trading day of the month resulted in the best returns.

The entire process of checking the website, logging into your brokerage account, and reallocating when necessary takes about 10 minutes. And you only have to do it once a month.

It really is that simple. In fact, even my children use this strategy in the custodial accounts that I opened for them. I set them up with Fidelity because there are no trading commissions or account fees, and they can buy fractional shares. This means that they can buy a fraction of a share of an ETF (or just about any business) for as little as $1.

My kids opened their accounts with $5 of their own money, and they’ve been slowly building their balance over time. (Well…most of them have…one of them is a bit of a spender.) The Papa Bear has been a great way to teach my kids about investing without bogging them down in technical research.

What if you can’t buy ETFs?

One challenge you may face with the Papa Bear is lack of access to ETFs. If you open an own account with one of the major online brokers, you’ll have no problem trading the 13 ETFs in the portfolio. If, however, you are using your company’s 401(k), 403(b), etc., you may run into an issue.

Many organizations only offer mutual funds in their employees’ retirement accounts. That’s a shame because some funds charge ridiculous fees that significantly reduce your returns over time. The limited offerings also force you to buy funds that you would otherwise avoid.

If this situation applies to you, you can still use the Papa Bear, albeit in any modified way. Study the funds offered by your employer’s plan. You may be able to invest in something similar to the ETFs in the Papa Bear.

For example, as I write this, Vanguard’s S&P Small-Cap 600 Value ETF ($VIOV) is one of the Papa Bear’s top 3 ETFs. If you can’t buy $VIOV or its corresponding mutual fund in your retirement account, you may be able to find something similar. Scan through your options and see if there is a small-cap value fund available. If not, you may have to settle for an overall small-cap fund that isn’t limited to value stocks. While this won’t give you an exact match to the Papa Bear allocation, it’s close.

If your fund options are extremely limited, and you can’t even get close to matching the Papa Bear, here’s what I recommend. Contribute enough to your company’s plan to maximize the employer match. For example, if your employer matches 50% of your contributions up to 6%, contribute the full 6%. Take advantage of the free money.

If you are able to allocate more to your retirement savings, open your own IRA or Roth IRA. This will give you the tax advantages of a retirement account coupled with a much greater selection of investments.

Keep in mind that there are limits to how much you can contribute to an IRA. If you hit those limits and still have money that you want to contribute to your retirement accounts, you may want to consider adding more to your company’s plan. Otherwise, you can put the money in a brokerage account. You won’t get the tax advantages, but you’ll still be able to invest.

One other disadvantage to mutual funds is that many employer plans prevent you from reallocating every month. They consider this frequency to be “active trading” and have rules against it. If you’re in this situation, your best option may be to choose a low-cost index fund to earn your full company match. Then, you can follow the process I outlined above to implement the Papa Bear strategy.

Finally, if your employer only offers a poor selection of mutual funds, and you end up leaving your job, I encourage to roll your money out of that plan right away. This will not only give you far better investment options, but it may also spare you from paying substantial fees. This is because many plans differentiate between employees and non-employees.

If you hold mutual funds in an employer plan, you pay an administrative fee. If you leave your company, that fee may increase many times over — even if you keep your investments exactly the same!

The difference in fees can be massive. One of the organizations that I worked for increased my fees 30 times over when I left the employer plan! If you find yourself in this situation, set up a rollover IRA right away. It’s very simple and shouldn’t cost you anything.

It’s both/and, not either/or

One of my core investing principles is that you don’t have to choose between long-term investing and short-term trading. You should use both strategies to achieve your financial goals.

I write extensively about how to achieve profits many times larger than typical buy-and-hold strategies. This does not mean, however, that there is no place for long-term investing. You need both.

The Papa Bear portfolio is one of the best performing, low risk, and time-saving strategies available. Again, I have no affiliation with Muscular Portfolios or its founder, Brian Livingston. I recommend this strategy based on my personal experience with it and its supporting research. I also love how helpful it’s been to teach my kids about investing.

Happy trading,

Jason Milton

Disclaimer: I’m not a stock broker or financial adviser. I cannot and do not provide personal investment advice, and The Antagonist should never be interpreted in such a way. This newsletter is intended for informational and educational purposes only. My recommendations represent the actions that I plan to take or have made based on my analysis and what works for me. Any investments that you make are your responsibility. Therefore, it is imperative that you perform your own due diligence before replicating any of my trades.

Subscribe to Antagonist Stocks and Options Research

Earn extra income with stocks & options, even if you have a full-time job & a full-time life. No day trading or crazy risks either. Beginners welcome.

As May comes to a close this week, seems the same 3 are still there : VUG, IAU, VEA.